Segments

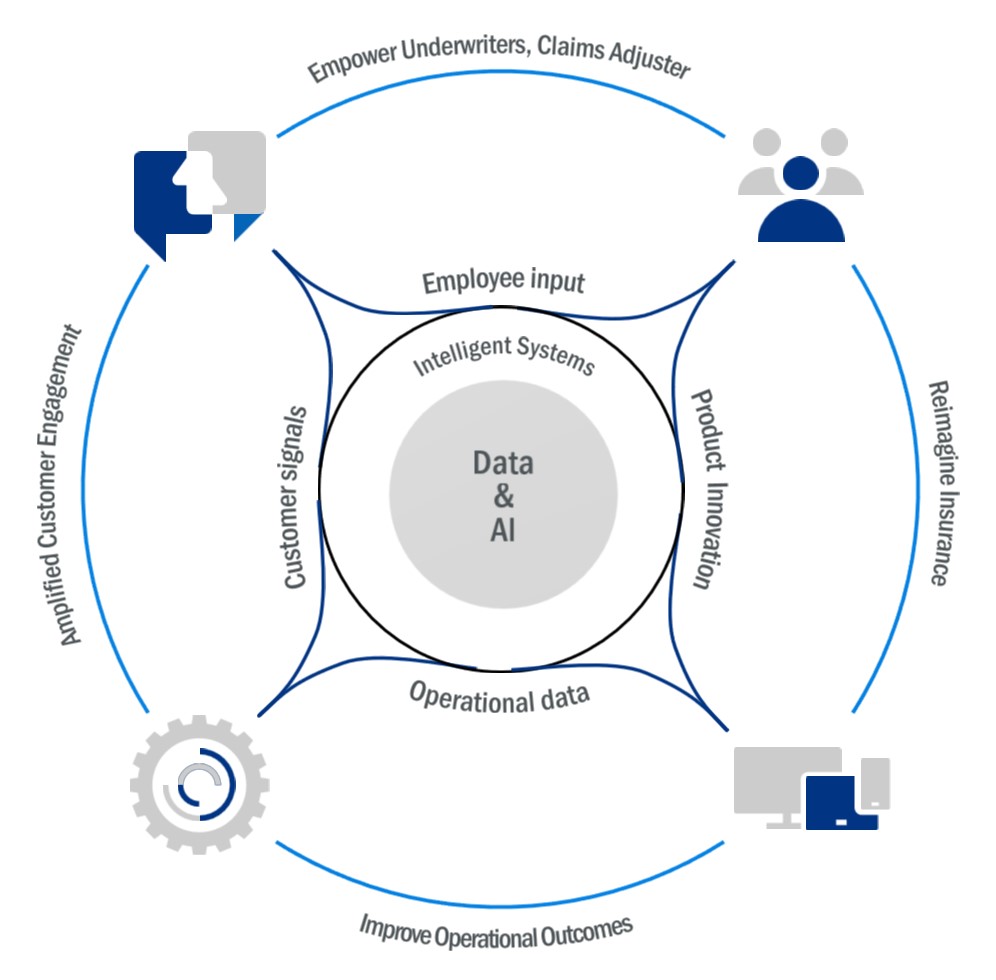

In the realm of Personal and Commercial Lines insurance, our AI-driven technology solutions are tailored to address the challenges of underwriting complexity and regulatory compliance. Leveraging advanced machine learning algorithms and generative AI capabilities, we offer AI-powered underwriting solutions that enhance accuracy and efficiency in risk assessment, allowing insurers to make data-driven decisions swiftly and with confidence.

Our digital transformation services streamline processes, from policy issuance to claims management, optimizing customer experiences through intuitive digital interfaces and automated workflows. Data-driven insights derived from extensive analytics empower insurers to personalize offerings, forecast trends, and segment markets effectively. Cloud-driven transformation ensures scalability and security, enabling seamless integration of new technologies while meeting stringent regulatory requirements.

In the realm of Reinsurers, our AI-driven technology solutions are pivotal in addressing the challenges of managing global risks and regulatory complexities. Advanced analytics and modeling techniques enable reinsurers to assess and price risks accurately, enhancing portfolio diversification and resilience against catastrophic events. Digital transformation initiatives streamline operational workflows and enhance collaboration across global teams, ensuring agility and efficiency in risk management processes.

Data-driven insights derived from comprehensive analytics empower reinsurers to optimize capital allocation and strategic decision-making, leveraging cloud-driven solutions for scalable infrastructure and enhanced cybersecurity measures. By integrating AI, digital, data, and cloud-driven transformations, we enable reinsurers to navigate competitive landscapes confidently while delivering value and innovation to their clients worldwide.

Insureds

Empower policyholders with self-service capabilities and personalized insurance solutions.

- Policyholder engagement Increase in web and mobile interactions Adoption rate of AI-driven customer service tools

- Claims processing efficiency Reduction in claim resolution time

- Customer satisfaction with claims handling Customer retention Improvement in renewal rates Net Promoter Score (NPS) for AI-enhanced services

- Risk prevention Adoption of AI-powered risk assessment tools Effectiveness in loss prevention strategies

Operations

Optimize operational efficiencies across the insurance value chain using AI technologies.

- Process efficiency: Reduction in turnaround time for policy issuance and Cost savings from Al-driven operational improvements

- Resource allocation: Optimal deployment of Al and human resources - Reduction in operational bottlenecks

- Compliance and risk mitigation: Improvement in regulatory compliance and Identification and mitigation of operational risks through Al analytics

Employees and Producers

Equip teams with Al tools to streamline decision-making and improve productivity.

- Underwriting accuracy, Reduction in underwriting errors

- Increase in premium pricing accuracy Claims handling efficiency

- Speed of claims processing, Accuracy of claims assessment

- Agent productivity, Effectiveness of Al-driven lead generation

- Customer satisfaction with agent interactions Operations

Products

Innovate insurance products through Al-driven insights to meet evolving market demands.

- Product development speed-Time to market for new insurance products

- Customer adoption - Customer retention rates for Al- customized products

- Risk management - Accuracy of predictive modeling and Reduction in claims frequency and severity

Our Comprehensive Insurance Offerings

Explore how Infinite’s tailored solutions drive digital transformation in insurance.

01 –

Tailored Insurance Product Suite for the Contemporary Insurer: Customizable solutions to meet modern insurance demands.

02 –

AI-driven Claims Processing: Streamlined workflows with AI-driven claims automation.

03 –

AI-driven Underwriting and Pricing: Data-driven insights to optimize risk assessment and pricing.

04 –

CRM Integration for Customer-Centric Experience: Enhancing customer interactions through seamless CRM integration.

05 –

Transforming Insurance Billing Processes: Efficiency improvements in billing and invoicing workflows.

06 –

Language Model Solution for Enhanced Risk Management: Cutting-edge tools for proactive risk mitigation.

07 –

Insurance Operations Transformation Suite – Infinite’s TPA Services: Outsourced solutions for optimized operational efficiency.

08 –

Legacy Modernization: Modernize to stay competitive with our Legacy Modernization solution that transforms outdated systems into agile, omnichannel platforms focused on customer engagement.

Capabilities enabling better experiences, better insights, better resilience

Tailored Insurance Product Suite for the Contemporary Insurer: Customizable solutions to meet modern insurance demands.

AI-driven Claims Processing: Streamlined workflows with AI-driven claims automation.

AI-driven Underwriting and Pricing: Data-driven insights to optimize risk assessment and pricing.

CRM Integration for Customer-Centric Experience: Enhancing customer interactions through seamless CRM integration.

Transforming Insurance Billing Processes: Efficiency improvements in billing and invoicing workflows.

Language Model Solution for Enhanced Risk Management: Cutting-edge tools for proactive risk mitigation.

Insurance Operations Transformation Suite – Infinite’s TPA Services: Outsourced solutions for optimized operational efficiency.

Legacy Modernization: Modernize to stay competitive with our Legacy Modernization solution that transforms outdated systems into agile, omnichannel platforms focused on customer engagement.

Our Comprehensive Insurance Offerings

Explore how Infinite’s tailored solutions drive digital transformation in insurance.

Insights & Resources

Insights and Resources for Insurance

Stay updated with the latest trends, insights, and resources in the Insurance industry.

End-to-end services removed friction, reduced cost and enabled growth.