About the Company

A Digital Bank in the U.S.

Background of Business Problem

- Manual validation during check processing at the digital bank led to frequent inaccuracies, inefficiencies, and delays, resulting in a poor customer experience.

- The outdated processes increased errors and hindered operational efficiency. As a result, the bank struggled to keep up with evolving customer needs and technological advancements, limiting its ability to deliver a seamless and modern banking experience.

Our Approach & Solution

Infinite used AI and RPA to automate three processes:

- During the assessment, several critical factors were identified, including high levels of manual interventions, complex workflows, a lack of automation, and significant rates of check rejection. These issues caused errors, operational inefficiencies, and customer dissatisfaction, highlighting the urgent need for a streamlined and automated solution.

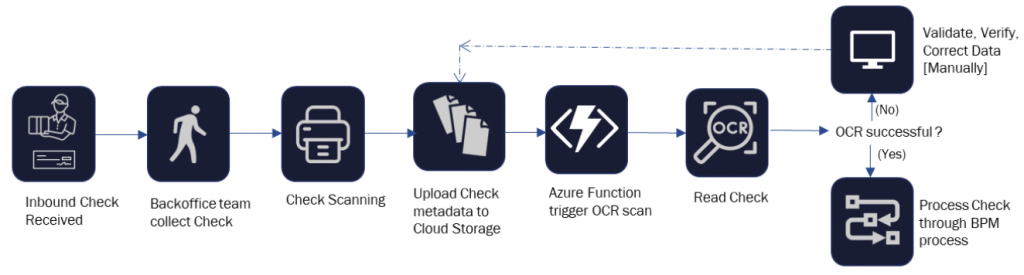

- In response, Infinite implemented an intelligent automation solution. This solution utilized Azure AI Vision for Optical Character Recognition (OCR) capabilities and integrated Camunda BPM for workflow automation.

- Together, these technologies automated the entire check processing workflow, significantly improving accuracy, reducing processing times, and enhancing overall operational efficiency. As a result, the bank was able to provide a more reliable and efficient service, ultimately leading to higher customer satisfaction.

During the assessment, several critical factors were identified, including high levels of manual interventions, complex workflows, a lack of automation, and significant rates of check rejection. These issues caused errors, operational inefficiencies, and customer dissatisfaction, highlighting the urgent need for a streamlined and automated solution.

In response, Infinite implemented an intelligent automation solution. This solution utilized Azure AI Vision for Optical Character Recognition (OCR) capabilities and integrated Camunda BPM for workflow automation.

Together, these technologies automated the entire check processing workflow, significantly improving accuracy, reducing processing times, and enhancing overall operational efficiency. As a result, the bank was able to provide a more reliable and efficient service, ultimately leading to higher customer satisfaction.

Business Outcomes

End-to-End Automation helped with enhanced customer satisfaction along with:

70%

Improvement in transaction times

60%

Reduction in overall end-to-end processing time